How Many US Leases Will Go On The Balance Sheet in 2021?

Great question. Impossible to answer. But let’s try out some math.

According to a recent US business census, there were 5.8 million businesses registered in the USA. This includes everything from a 1-person marketing freelancer to Fortune 100 Company.

Within those 5.8 million businesses, there were 7.5m registered ‘establishments’. An establishment is a ‘Location’ for a business. A business could have multiple ‘Locations’.

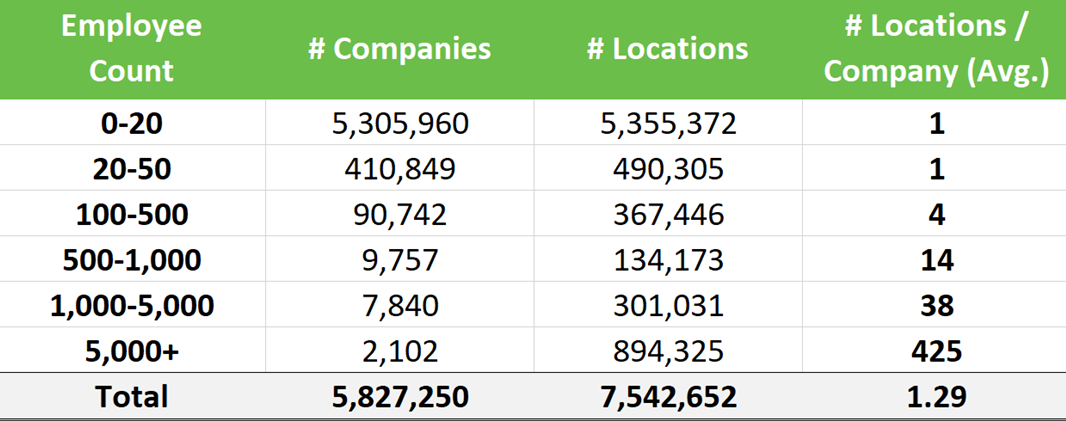

Now, let’s break down the number of ‘Locations’ into cohorts by company size, by company Employee Count:

Over 70% of US businesses only have 1 Location, which makes sense. This could be an LLC registered at a home address or a flexible co-working space.

Surprisingly, the mega companies have 425 locations on average. Without understanding the depth of the data, we can assume that retailers skew the data for larger companies. Pharmacies like Walgreens have 9,000+ locations, banks like Chase have 20,000+ branches/ATMs, while restaurants like McDonalds have 35,000+ locations.

So 7.5 million US Leases Will Go On The Balance Sheet?

Not so fast. We’re talking about GAAP compliance. So let’s assume that only companies with 20+ employees will consider maintaining a Balance Sheet under US GAAP. This leaves us with 500,000+ companies and 2.2 million ‘Locations’. There are certainly exceptions, such as establishments that are ‘owned’, and the occasional short-term lease.

So ~2 million US Leases Will Go On The Balance Sheet?

According to ASC 842 the new accounting standard, a material lease is not just an office location. It can include equipment, vehicles, servers, or tiny medical devices. Companies with a copier lease may have to put it on the Balance Sheet!

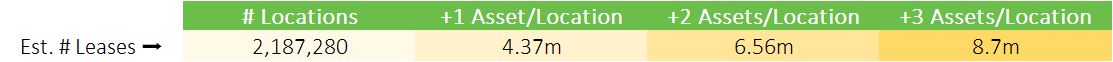

So we need to consider not just how many locations companies have – rather, how many leased Assets they have.

We can use an asset multiplier to determine how many additional leased assets companies have. If a company has 3 copiers, they have +3 leased assets:

So 8.7m US. Leases Could Go On The Balance Sheet?

Yes. If we assume that Companies have 3 assets per Location, on average. This doesn’t give us an exact answer but you can get a sense for how many leases will need to be:

- Extracted and entered, by accounting teams

- Audited and verified, by accounting teams

- Applied rules of ASC 842 guidance

- Rolled up into journal entries & disclosures

- Managed in a centralized location

Bonus: How Much Liability Will Be Transferred Onto US Balance Sheets?

According to Deloitte and WSJ, it will be at least $2bn in the S&P 500.

To include private companies it becomes more difficult. We can use Commercial Real Estate data to make some estimates. There is $10bn+ in Commercial Property Value across these sectors (Source: REIT.com)

- Office – $2.5b

- Retail – $2.4b

- Health Care – $2.3b

- Hospitality – $1.6b

- Industrial – $1.5b

- Flex $0.3bn

At the average 85% US occupancy rate, that’s $9bn in lease obligations across these verticals – without discounting for property rental margins.

We’ll handle the massive equipment leasing market another day :-).